how to claim eic on taxes

Claiming Child When Divorced. In 2021 married filing jointly and married filing separately taxpayers who are at least 65 years old or blind can claim an additional standard deduction of.

Eic Frequently Asked Questions Eic

Virtual currency like Bitcoin has shifted into the public eye in recent years.

. Tax Tips for Uber Driver-Partners. If the parent of the child is the qualifying child of the grandparent the parent may not take the EITC. Alimony and Child Support.

Additional fees apply with Earned Income Credit and you file any other returns such as city or local income tax returns or if you select other products and services such as Refund Transfer. Do you claim workers comp on taxes the answer is no. Child and Dependent Care.

Dependents for Head of Household and EIC. You can claim their children your grandchildren that live with you if your son or daughter does not claim them they live with you more than 12 of the year and your income is higher than your childs income. To meet the qualifying child test your child must be younger than you and either younger than 19 years old or be a student younger than 24 years old as of the end of the calendar year.

Theres no age limit if your child is permanently and totally. A waiver is the voluntary action of a person or party that removes that persons or partys right or particular ability in an agreement. So if you overpay your state taxes and receive a refund you may need to report it as income on next years federal.

Dependents are added under the personal info tab. A tool that may help is Publication 3524 EITC Eligibility Checklist PDF or 3524 Spanish Version PDF. Page one of the 2021 Schedule EIC form alongside the cover page of the 2021 Schedule EIC instructions booklet.

You have three years to file and claim a refund from the due date of your tax return. Available at participating US. To claim your child as your dependent your child must meet either the qualifying child test or the qualifying relative test.

If you qualify for the federal earned income tax credit and claim it on your federal return you may be entitled to a Maryland earned income tax credit on the state return equal to 50 of the federal tax credit. How Bonuses Are Taxed. Tax Deductions for Job Hunters.

Filing Taxes for On-Demand Food Delivery Drivers. If the parents AGI is higher than the AGI of the grandparent the grandparent may not claim the child as a qualifying child for the EITC or other child-related. Filing as a Widower Kids and Taxes.

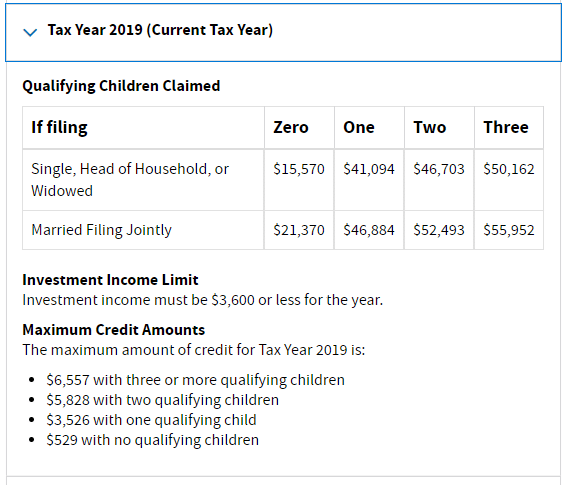

Earned Income Credit. Some employees are paid with Bitcoin more than a few retailers accept Bitcoin as payment and others hold the e-currency as a capital asset. The Earned Income Tax Credit also known as Earned Income Credit EIC is a benefit for working people with low to moderate income.

Page two of IRS Form 1040A and Form 1040 both request that you attach Schedule EIC if you have a qualifying child and wish to claim the Earned Income Credit EIC. Tax Filing Tips for Hair Salons Barbers and Hairdressers. Recently the Internal Revenue Service IRS clarified the tax treatment of virtual currency transactions.

If you have a qualifying child you must also file the Schedule EIC Form 1040 or 1040-SR Earned Income Credit to give us information about them. First find the exact amount you received for the third stimulus payment. If you were eligible you can still claim the EITC for prior years.

Claim the EITC for Prior Years. For example an individual will be disallowed the earned income credit if they claim when not eligible due to reckless or intentional disregard of the EIC rules In addition making fraudulent claims for the credit can disallow an individual for 10 years. What Is Form 1040 Schedule EIC.

Who Can You Claim. The dependent interview has changed in 2011. If you didnt receive the full amount of your third stimulus payment well help you claim the Recovery Rebate Credit when you file your 2021 taxes or your 2021 amended return and make sure you get the money you qualify for by double-checking the amount you received.

However if your state doesnt require the payment of income taxes or you suspect that you pay more in sales taxes you can deduct your sales tax payments insteadbut you can never deduct both.

Earned Income Tax Credit Tax Graph Income Tax Income Tax Credits

Earned Income Tax Credit For 2020 Check Your Eligibility

What Is The Earned Income Tax Credit And Why Does It Matter For Your Taxes Gobankingrates

Earned Income Tax Credit Montanalawhelp Org Free Legal Forms Info And Legal Help In Montana

What Is The Earned Income Credit Check City

How To Claim Earned Income Tax Credit For 2021 Taxes Eitc Youtube

Who Qualifies For The Earned Income Tax Credit Shared Economy Tax

Summary Of Eitc Letters Notices H R Block

Pin On Organizing Tax Information

Eligible Taxpayers Can Claim Earned Income Tax Credit Eitc

2021 Schedule Eic Form And Instructions Form 1040

Illinois Earned Income Tax Credit Do You Qualify Pasquesi Sheppard